geothermal tax credit form

The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. A 26 federal tax credit for residential ground.

Geothermal Comparison Table Geothermal Geothermal Heat Pumps Heating And Cooling

Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want.

. Geothermal tax credits are back. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does. The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018.

Taxpayers filing a claim for the Geothermal. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018.

Who Can Take the Credits You may. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does. Include this form and the IA 148.

Do not complete Part II. The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps. Geothermal Tax Credits Geothermal system tax credits are unaffected by these changes and remain in place as is through 12312016.

Residential Energy-Efficient Property Credit. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was. Therefore the signNow web application is a must-have for completing and signing fillable online understand the geothermal tax credit on the go.

This includes labor onsite preparation equipment. The tax credit decreases to 26 in 2020 and 22 in 2021. Use IRS Form 5695 to claim the Residential Energy Efficient.

Geothermal heat pumps placed in service starting in. In December 2020 the tax credit for. Property is usually.

Also use Form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused portion of the credit to 2022. This credit was repealed by the 2021 Montana State. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and.

The incentive will be lowered to 22 for systems that are installed. Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit. Iowa Geothermal Tax Credit httpstaxiowagov 41-169a 071218 Names _____SSN _____ Part I Information about the geothermal heat pump system.

The tax credit may be claimed for spending on equipment which uses. Geothermal Tax Credit Explanation. Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want.

In a matter of seconds receive an electronic. Home Memphis Documents Posts Geothermal System Credit Form ENRG-A December 30 2021 by Montana Department of Revenue. Enter this amount on Line 4 of IRS Form 5695.

A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. US Tax Credits Through 2023.

However if the system is part of the construction or renovation of a house its considered placed in service when the taxpayer takes residence in the house. Geothermal heat pump tax credits and depreciation deductions can only be claimed by the owner of the eligible. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file.

Great news but first things first a geothermal heat pump is a state-of-the-art heating and cooling system. Use the manufacturers certification statement and saved receipts to calculate the total costs eligible for the geothermal tax credit. They are energy efficient better for the.

Taxpayers filing a claim for the Geothermal Tax Credit were. If you checked the No box you cannot claim the nonbusiness energy property credit.

Questions Answered Federal Tax Credits And Local Incentives For Residential Geothermal Installation

Pdf Intensive Thermal Exploitation From Closed And Open Shallow Geothermal Systems At Urban Scale Unmanaged Conflicts And Potential Synergies

Enhanced Geothermal System Renewable Energy Geothermal Geothermal Energy Alternative Energy

Processes Free Full Text The Use Of Geothermal Energy For Heating Buildings As An Option For Sustainable Urban Development In Slovakia Html

Cost Accounting Management Guru Cost Accounting Accounting Business Tax Deductions

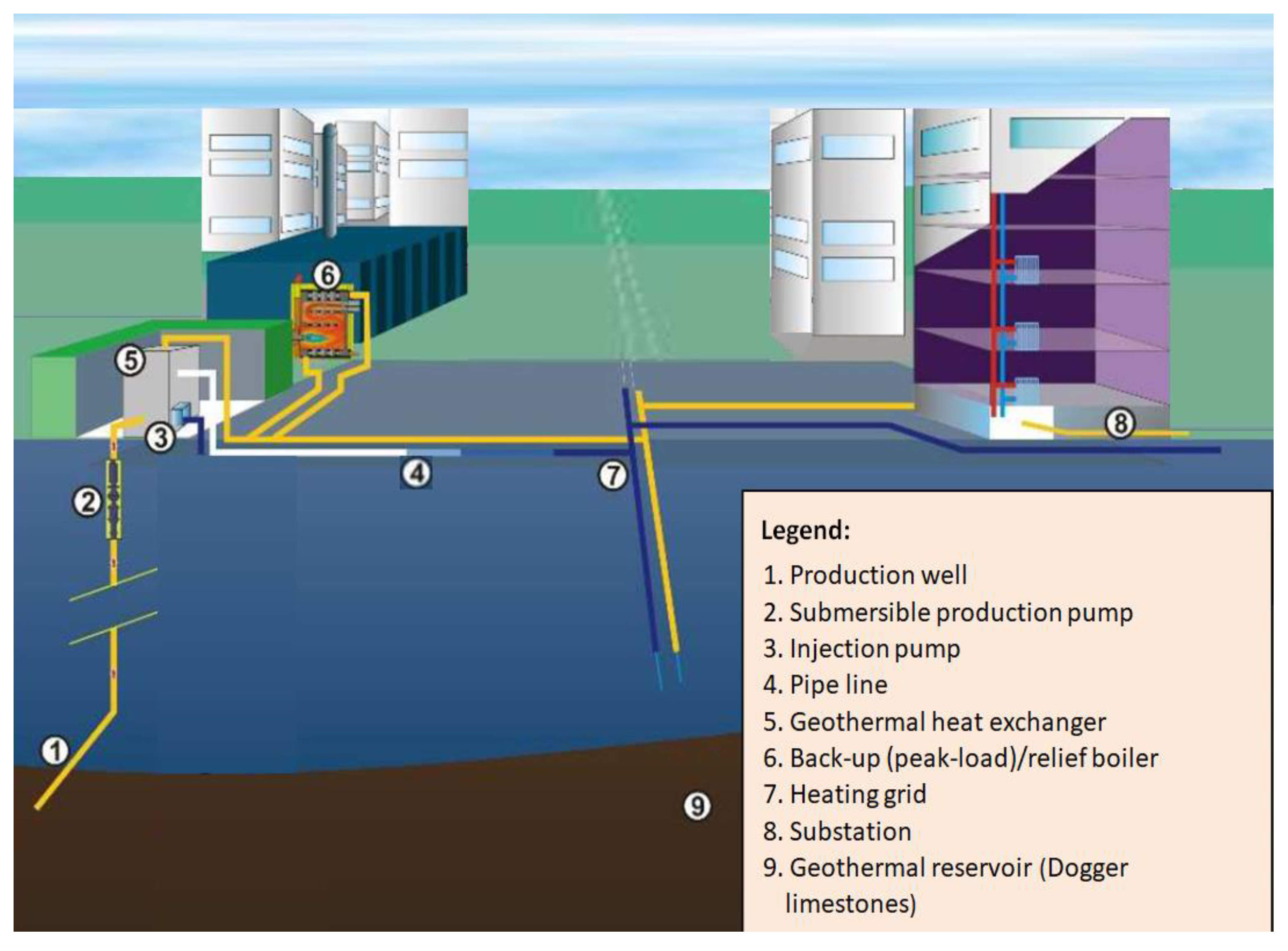

Diagram Of A Doublet For Hydrothermal Exploitation Download Scientific Diagram

Pin On Global Warming And Green Energy

Home Energy Audit Evaluating Efficiency Energy Audit Save Energy Energy Efficient Homes

1 Increase Of The Installed Power Of Geothermal Heat Pumps In The Eu 12 Download Table

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

6 Ways Indoor Air Pollution Affects Your Health Lungs Health Mold Exposure Health

Biomass Energy Foundation History Biomass Energy Biomass Energy

Heat Pumps Explained Ground Source Heat Pump Geothermal Energy Heat Pump

The Federal Geothermal Tax Credit Your Questions Answered

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Types Of Energy Turbine Coloring Sheet Coal Energy Concentrated Solar Power Biomass Energy